Not known Factual Statements About Medicare Plan G Joke

Wiki Article

The Only Guide to Boomerbenefits Com Reviews

Table of ContentsThe Main Principles Of Hearing Insurance For Seniors Some Of Aarp Medicare Supplement Plan FFacts About Plan G Medicare UncoveredEverything about Boomerbenefits.com ReviewsA Biased View of Medicare Plan G Joke

They have actually also upgraded Justice in Aging's Improper Invoicing Toolkit to incorporate recommendations to the MSNs in its model letters that you can utilize to promote for customers who have been incorrectly billed for Medicare-covered solutions. that will inform carriers when they process a Medicare case that the individual is QMB and has no cost-sharing responsibility. These modifications were arranged to enter into result in October 2017, however have been postponed. Learn more about them in this Justice in Aging Problem Short on New Approaches in Combating Improper Payment for QMBs (Feb. 2017). (by mail), even if they do not likewise get Medicaid. The card is the device for health care providers to bill the QMB program for the Medicare deductibles as well as co-pays.

Links to their webinars and other resources goes to this link. Their details includes: September 4, 2009, upgraded 6/20/20 by Valerie Bogart, NYLAG This post was authored by the Empire Justice.

An Unbiased View of Attained Age Vs Issue Age

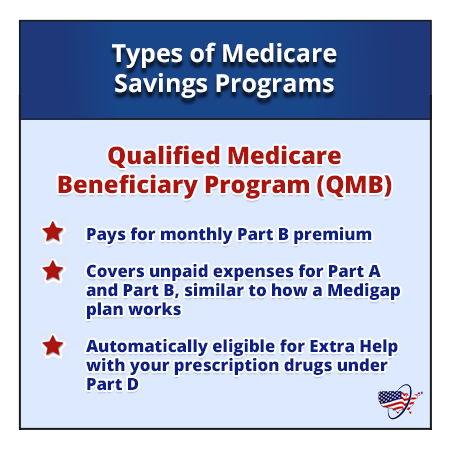

Each state's Medicaid program pays the Medicare cost-sharing for QMB program participants. Any person that gets the QMB program doesn't have to spend for Medicare cost-sharing and also can't be charged by their healthcare providers. If a person is thought about a QMB Plus, they meet all standards for the QMB program however also meet all economic demands to receive complete Medicaid solutions.

The initial step in registration for the QMB program is to locate out if you're qualified. You can ask for Medicaid to give you with an application form or locate a QMB program application from your state online.

There are circumstances in which states may restrict the quantity they pay wellness care companies for Medicare cost-sharing. Also if a state limits the quantity they'll pay a supplier, QMB members still don't need to pay Medicare companies for their health treatment prices as well as it's versus the regulation for a supplier to ask to pay - medicare oep.

Usually, there is a costs for the plan, but the Medicaid program will certainly pay that premium. Many individuals choose this added protection because it supplies routine oral and vision treatment, and some come with a health club membership.

Medigap Plan G - An Overview

Select which Medicare prepares you would like to contrast in your area. Compare rates side by side with strategies & service providers available in your area.He is included in numerous publications in addition to creates on a regular basis for other skilled columns pertaining to Medicare.

Many states allow this throughout the year, yet others restrict when you can sign up in Component A. Bear in mind, states utilize various rules to count your earnings as well as properties to determine if you are qualified for an MSP. Instances of income include salaries and Social Safety and security benefits you obtain. Instances of possessions consist of inspecting accounts and also stocks.

And also some states do not have an asset limitation. If your revenue or properties appear to be over the MSP guidelines, you should still read use if you require the help. * Qualified Handicapped Working Person (QDWI) is the 4th MSP and pays for the Medicare Part A costs. To be eligible for QDWI, you should: Be under age 65 Be working yet proceed to have a disabling problems Have limited earnings and assets As well as, not already be qualified for Medicaid.

Medigap Plan G for Dummies

20 for each brand-name medication that is covered. Extra Help just applies to Medicare Component D.

MSPs, including the QMB program, are carried out with your state's Medicaid program. That implies that your state will certainly establish whether or not you certify. For instance, different states might have different ways to compute your earnings as well as resources. Let's analyze each of the QMB program eligibility standards in more information listed below.

The regular monthly revenue limitation for the QMB program enhances yearly. That implies you should still use for the program, even if your income goes up somewhat. Resource limitations, Along with a regular monthly revenue limit, there is likewise a source restriction for the QMB program. Items that are counted towards this restriction include: money you have in checking as well as financial savings accountsstocksbonds, Some resources don't count toward the source restriction.

Attained Age Vs Issue Age Fundamentals Explained

, the resource restrictions for the QMB program are: $7,970 $11,960 Resource restrictions additionally raise every year. As with earnings limitations, you should still use for the QMB program if your resources have actually somewhat enhanced.Report this wiki page